Trade Crypto On Exness: A Comprehensive Overview

If you have been considering venturing into the world of cryptocurrency trading, you may have encountered various platforms that offer services for trading digital assets. One such platform is Exness, known for its user-friendly interface and robust trading features. This article will delve into the specifics of how to Trade Crypto On Exness trade crypto on Exness, the advantages of using this platform, and essential tips to enhance your trading strategies.

What is Exness?

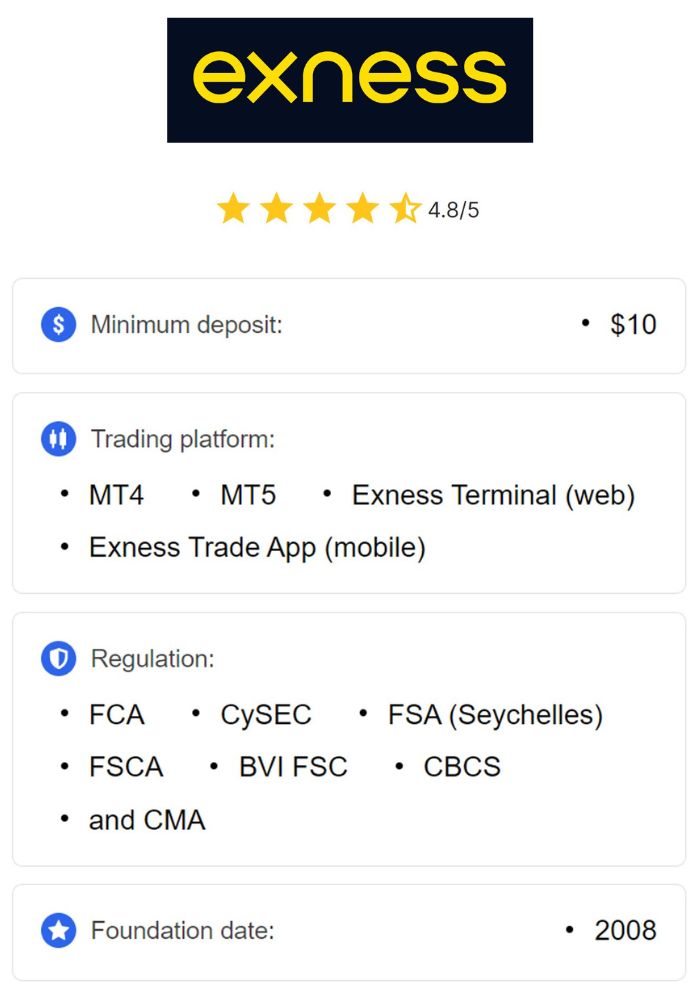

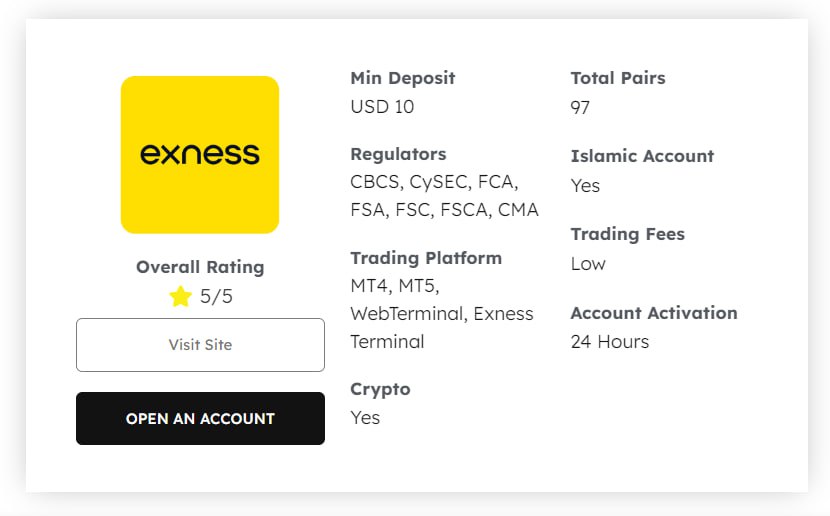

Exness is a well-established online brokerage that provides access to various financial markets, including Forex, CFDs, and cryptocurrencies. Founded in 2008, the platform has gained popularity among traders due to its competitive spreads, leverage options, and commitment to transparency. As of now, Exness operates globally, catering to millions of clients across different regions.

Why Trade Crypto on Exness?

Cryptocurrency trading has surged in popularity due to the potential for high returns and the increasing acceptance of digital assets in the financial world. Here are several reasons why trading crypto on Exness can be beneficial:

1. User-Friendly Interface

Exness provides a straightforward trading interface that caters to both beginners and experienced traders. This ease of use is crucial in navigating the volatile crypto market efficiently.

2. Variety of Cryptocurrencies

The platform offers a range of cryptocurrencies for trading, including Bitcoin, Ethereum, Litecoin, and many others. This variety allows traders to diversify their portfolios and take advantage of different market movements.

3. Leverage Options

Exness offers competitive leverage options, which can amplify trading potential. However, it’s essential to approach leverage with caution, as it can also increase risks.

4. High Security Standards

Security is a major concern for online traders, especially in the crypto space. Exness employs advanced security measures, including two-factor authentication and encryption, to protect trader funds and personal information.

5. Customer Support

Exness prides itself on providing excellent customer support. Traders can reach out to support representatives through various channels, ensuring that assistance is readily available when needed.

Getting Started with Crypto Trading on Exness

To begin trading cryptocurrencies on Exness, follow these simple steps:

Step 1: Create an Account

Start by visiting the Exness website and registering for an account. Ensure that you provide accurate information and complete any necessary verification processes to comply with regulatory standards.

Step 2: Fund Your Account

Once your account is set up, you’ll need to deposit funds. Exness offers various funding options, including bank transfers, credit/debit cards, and e-wallets, making it convenient for traders.

Step 3: Choose Your Trading Platform

Exness provides multiple trading platforms, including MetaTrader 4, MetaTrader 5, and a web-based platform. Choose the one that suits your trading style and preferences.

Step 4: Start Trading

Now that your account is funded, you can start trading cryptocurrencies. Explore different trading pairs and use the tools available on Exness to help analyze the market.

Trading Strategies for Success

Successful crypto trading often requires the implementation of effective strategies. Here are some popular strategies that traders can consider:

1. Day Trading

Day trading involves making multiple trades within a single day. Traders capitalize on small price movements and typically close positions before the day ends to avoid overnight risks.

2. Swing Trading

Swing trading entails holding onto positions for several days or weeks, aiming to benefit from expected market movements. This strategy requires patience and a solid understanding of market trends.

3. HODLing

HODLing is a long-term investment strategy that involves buying and holding cryptocurrencies for an extended period, regardless of price fluctuations. The goal is to profit from long-term price appreciation.

4. Arbitrage

Arbitrage involves buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another. This strategy requires quick execution and can yield profits in fluctuating markets.

Risk Management in Crypto Trading

Investing in cryptocurrencies involves risks, and managing those risks is crucial for long-term success. Here are some essential risk management strategies:

1. Set Stop-Loss Orders

Implementing stop-loss orders can help limit losses by automatically closing a position when the price reaches a specified level.

2. Diversify Your Portfolio

Avoid putting all your funds into a single cryptocurrency. Diversifying your portfolio can help mitigate risks associated with individual assets.

3. Never Invest More Than You Can Afford to Lose

It’s essential to invest only the amount you are willing to lose, especially in the volatile crypto market. This mindset can help maintain a healthy emotional perspective while trading.

Conclusion

Trading crypto on Exness can be a rewarding venture if approached with the right knowledge and strategies. With a user-friendly platform, diverse cryptocurrency options, and robust security measures, Exness offers an excellent environment for both novice and experienced traders. However, always remember that the cryptocurrency market comes with its own set of risks. By developing effective trading strategies, implementing sound risk management practices, and continuously educating yourself, you can navigate this exciting market with confidence.